If you’re in the world of retail, you’re likely familiar with the concept of analyzing your own data to improve your business.

Similar to how people counting solutions and foot traffic data can be used to gauge the number of potential customers in your store, figures obtained from your sales activities can help you determine how efficiently your business is run and how your operations could be improved.

One such figure that’s important for both brick and mortar shops as well as online retailers is average transaction value, or ATV for short.

Related: 15 Key Metrics (KPIs) to Measure Retail Store Performance

What is average transaction value?

As the name suggests, average transaction value is the average amount of money – usually measured in dollars – spent by a consumer on a single transaction.

To calculate the ATV for your retailer, all you have to do is divide the total value of all transactions within a specific time frame by the number of transactions that occurred during that timeframe.

ATV = Total value of all transactions / Number of transactions

Let’s say you want to calculate the ATV for your clothing store from 2-6 PM on a Saturday. You would first take the total value of all transactions made at your store during that four-hour window, which we’ll assume is $10,000.

Then, you would look at the number of transactions for that same time period, and here we’ll say you had 200 transactions. That would mean your clothing store had an average transaction value of $50 for that particular Saturday afternoon.

Why is it important to measure average transaction value?

Generally speaking, it is harder for retailers to draw in new customers than it is to cater to their existing clientele.

With this fact in mind, your goal in measuring the ATV for your retailer should be to increase the amount spent by the customers you already have.

To revisit the clothing store example, you can use your ATV from that particular Saturday afternoon – $50 – to set a new ATV goal of $55 for the following week. Assuming you had the same number of transactions as the previous weekend, that $5 increase per transaction would put your Saturday afternoon earnings at $11,000 – meaning your business could pull in $1,000 more without changing the volume or type of customer it attracts.

Related: How to Calculate (and Increase) Retail Conversion Rate

Most modern POS systems will readily display your average transaction value from a certain time, but if you want to do a more thorough analysis of your customer base, it’s a good idea to combine this information with data from your door counter.

According to a 2011 study on how foot traffic affects sales and conversion rates in retailers, “increasing average traffic per hour by 1 unit increases average sales volume per hour by $9.97” – so, if your store gets a lot of foot traffic during a certain time period with little to no effect on conversion rates or ATV, you’ll know it is time to make improvements.

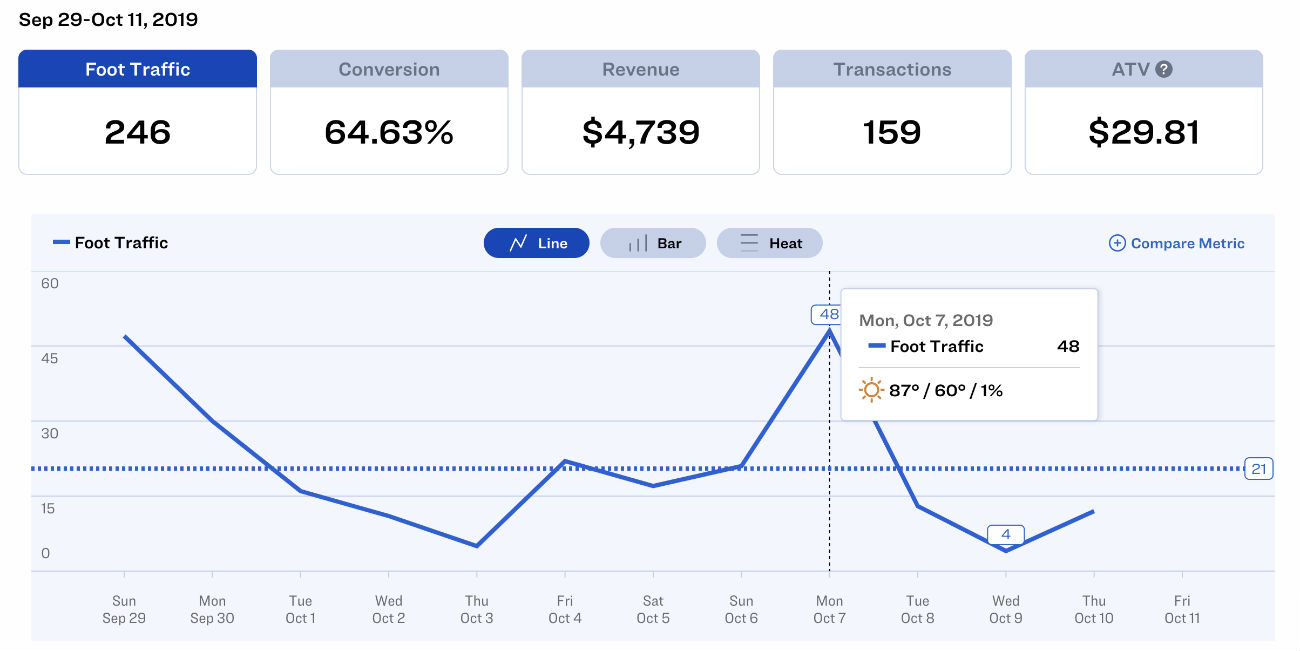

You could try amalgamating your foot traffic data and ATV manually, but nowadays you can also find advanced people counter solutions like Dor’s thermal foot traffic counter, whose API easily integrates with your existing POS system to display foot traffic data, conversion rates and ATV information, all on a single dashboard screen.

Click here to discover how a people counting solution like Dor can help you understand your store's ATV and other important metrics on a single screen.

What is the average transaction value for retailers?

Although the average transaction value will vary greatly from one store to the next due to a number of factors, there are certain figures that are applicable to the retail industry as a whole.

According to data from Vend’s 2019 Retail Benchmarks Report, the global average transaction value in retail was $54.14 this year, reflecting a slight increase from last year’s $53.98.

As conventional wisdom would suggest, retailers of big-ticket items had the highest ATV in 2018, with furniture stores averaging $248.42 per transaction, followed by jewelry, luggage and leather goods stores at $126.87. By contrast, the lowest ATV came from specialty food stores, with an average figure of $22.88, followed by beer, wine and liquor stores at $33.12.

Of course, these figures may not perfectly correlate to your business, but knowing where you fit in within the global trend for your retail category will likely inform any decisions you make to improve your ATV.

Let's see what we can do to increase our average transaction value!

1. Make the most of your salespeople

Properly training your salespeople is crucial if you want to up your ATV game.

Ideally, you want them interacting with customers from the moment they walk into your store. Not only must they know enough about your merchandise selection to answer any questions they receive from potential customers, but your sales associates should also actively try to up-sell or cross-sell items.

Related: 5 Retail Associate Skills to Boost In-store Conversions

For those unfamiliar with these terms, up-selling is where a sales associate encourages a customer to spend more for an item than he or she originally intended.

The general rationale behind up-selling is that the customer may spend more money upfront, but the item will last them longer than a cheaper alternative, thus saving them money in the long run.

By contrast, cross-selling is when a sales associate encourages the customer to purchase additional items that complement the original item they came to buy.

In our clothing store example, up-selling would be convincing the customer to purchase a $100 jacket instead of a $50 one, while cross-selling would be persuading them to buy jeans and a t-shirt along with the jacket.

Depending on the size of your retailer, you can even set specific sales and ATV goals per salesperson, or you can encourage your employees to compete for higher ATVs by offering them bonuses and other incentives to succeed.

2. Effective merchandising is key

If you’re a retailer, one of the simplest ways to boost engagement between your customers and your salespeople is to limit the amount of merchandise on the floor.

Not only will this give your space a more showroom-like feel, but it will encourage customers to consult your employees for assistance, giving them the opportunity to up-sell and cross-sell products throughout your store.

Another important factor to consider is impulse purchases. Naturally, you want your customers making as many impulse purchases as possible, so it’s a good idea to store small, affordably priced and eye-catching items near the cash register, along with gift cards they can purchase for their loved ones.

3. Use sales and promotions to your advantage

Regardless of the type of retailer you operate, there are at least two or three items throughout your store that could – and should – be sold together.

If you’re a hardware store, this can be a simple set of tools, or if you’re a stationery store, it can be a curated selection of back-to-school items. The idea here is to offer “bundle deals” on products so that customers perceive they’re getting a good deal while you increase your average transaction value.

Related: 15 Video Marketing Tips for Retailers to Increase Sales

Another idea aimed specifically at raising the ATV is to offer promotions for a set amount of money spent at your store – offers like 10% off $100 or $20 back for every $500 spent in-store can do wonders to drum up sales.

4. Beef up your loyalty program

Knowing the ATV for your retailer can also help you segment your sales and promotional offers.

For instance, if you’ve determined that there is a group of customers who routinely spend around $50 more than the average customer, you may choose to offer them a loyalty program where they’ll earn points to spend in-store or receive perks like gift vouchers on their birthday.

Related: 15 Email Marketing Tips for Retailers to Increase Sales

A well-designed loyalty program will not only help you keep existing customers and draw in new ones, but it may even assist you in selling slow-moving merchandise. If you’ve got a loyalty program based on points, you can try this psychology-based retail experiment: Assign more points than you would to a rather unpopular item and see if it raises the item’s perceived value in your customers’ eyes.

You just might be surprised at the results.

5. Offer flexible payment options

When we think of flexible payment options such as layaway or installments, we generally think of businesses that sell big-ticket items like electronics or furniture. But that doesn’t necessarily have to be the case.

Nowadays, there are fin-tech solutions that allow merchants to offer these types of payment options without having to open a line of credit. On the consumer side, the elimination of exorbitant interest fees is a huge benefit.

Depending on the type of retailer you operate, you can even use flexible payment options to incentivize your customers to spend more per purchase. For instance, you may require customers to spend $500 or more on a single purchase to take advantage of payment by installments, or offer layaway only for items valued at $1,000 or above.

Although the total number may be much higher than the customer was originally willing to spend, the fact that they’ll part with the money gradually instead of all at once may generate a profound psychological impact – which translates into a higher average transaction value for your business.