Product pricing is the age-old factor in the retail business. When miscalculated, the wrong retail product pricing can lead the business to an unprofitable stage where your valuable product is not getting the actual worth it deserves. This underselling of your product eventually leads to a smaller store, inadequate sales staff, and lost revenues.

Even though many factors will affect your product’s price while you're running the business, it's crucial to make the right retail calculations in the beginning, to ensure that you’re not making impulsive decisions.

There are a few basic rules to be considered about product pricing, and then you’ll feel comfortable when you apply your sales & marketing strategies for your retail business.

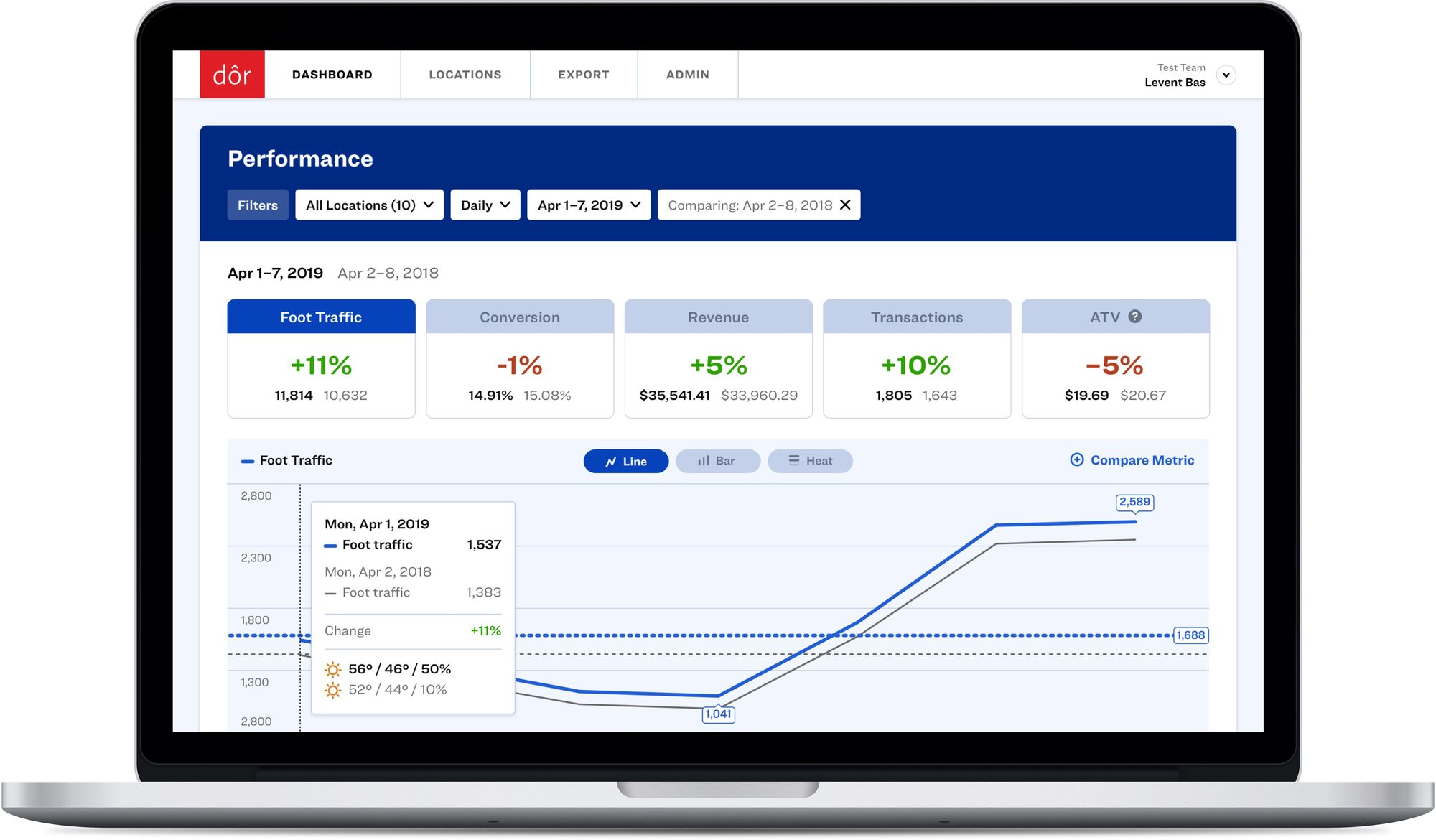

Did you know that a 1% increase in your store’s conversion rate can mean a 10% increase in revenue?

Click here to discover how Dor can help you understand your foot traffic data and make more profitable business decisions.

Ready to purchase? Complete your purchase in just minutes!

Why is initial product pricing important?

Product pricing is complicated and can sometimes be pretty overwhelming. To feel less stressed about this, you should acknowledge that pricing is tangible. You are free to work around your prices according to your sales, the season, or another unexpected event, such as a global pandemic.

It doesn't have to affect every product line you have; sometimes dynamic pricing can work for a low trending product, while for some products, the price doesn't change at all.

Related: 12 Successful Retail Pricing Strategies Every Retailer Should Know

Imagine the launch of every new line of iPhones. They have a fixed price, and as soon as the product is released, the previous versions are cheaper but not as cheap as to convince you not to buy the first version. That's why the initial product price is important, meaning you are your own competitor as well.

So far you may think that pricing strategies are complicated. The good news is product pricing is not at all. You should follow a few essentials, and you are good to do initial pricing on your products.

6 things to know about product pricing

1. Calculate the total cost of your product

You can start by defining the cost of goods sold for your product. This is the total cost of every little piece of money you spend when buying or producing your product.

If you’re buying the product, the cost of goods sold is the price on the invoice your supplier has sent you. If you’re a manufacturer, this is the total cost of raw material and craft, divided by the amount of produce.

Even if you buy the product from a supplier, you should always put an hourly rate for your time as craft cost. Your shipping cost to and from your warehouse/production facility or supplier is also an essential factor. You can simply calculate the total number of items you receive in one shipment and then divide your total shipping cost by that variable.

A simple formula for calculating the total cost of your product is

Cost of goods sold + Packaging + Marketing cost (divided by the total amount of products) + Shipping per item

2. Define the profit margin

You are in this business to make a profit and maintain a sustainable business, so you should define your profit margin accordingly. Your profit margin may be affected by the other factors listed here, but this is the part where you can play with it.

The markup percentage varies from 20% to 50% depending on the industry, but the calculation is the same for each. Your final price should be competitive enough to make room for your business in the market, but at the same time, your margin should be as high as possible, so you, your partners, your employees, and your customers win in the end.

Here is a brief formula for the final product price:

Total Cost of Product + Markup % = Final Product Price

3. Include a margin for your general costs as well

Go back to your books and find out the monthly fixed costs such as rent, personal expenses, cleaning, etc.

This may also include your loans or debt service costs. According to your business plan, it's common to have a capital investment of future capital to this calculation. Then, it’s possible to figure out a contribution margin for your product. This may be as low as 0.01%, but it has to be there to remind you that this price affects the business as a whole.

4. Review the prices seasonally or when in need

The price of a product should not change very frequently, but there is always room for adjustment.

Especially during seasonal changes or unexpected increases in the cost of goods sold, you should always go back and do your retail math once again to make sure you’re not losing money. Follow your break-even point carefully, and make sure to intervene if your graph does not add up.

Related: 12 Real-Life Tips for Successful Retail Upselling and Cross-selling

5. Follow your competitors’ prices frequently

Take a tour around the block to your competitor's shop, or search their online stores to compare prices. You can add this to your to-do list and define the frequency of these visits, but to be up to date on when your competitors are changing their prices is very important.

Setting up alerts on major price competitor sites can be useful as well. Remember that larger retailers may have different pricing strategies for their online channels, so physical visits can be trustworthy to know real-time pricing.

6. Listen to your customers

Make sure you know what your customers are willing to pay for that specific product.

You can conduct market research, of course, but for those, you don't have the time and resources for, a small talk with your best customers may also do the trick. It's better to know the cost of the average invoice your customers leave you and work around this number. The more customer personas you create for your product, the more accurate your pricing will be.

Related: How to Calculate (and Increase) Retail Conversion Rate